Blog

By Kenny Butler

•

September 15, 2024

$3.4 Million Stolen and Over $1 Million Gambled Away: The Shocking Case of Mark Csantaveri For years, we’ve witnessed the vulnerability of small business owners who have fallen prey to fraudulent debt settlement companies. These companies, under the guise of alleviating business debt, often fail to deliver, leaving these already struggling business owners in even worse financial trouble. The recent DOJ announcement regarding Mark Csantaveri’s scheme to defraud over 50 small businesses is a stark reminder of this danger.

By Kenny Butler

•

September 15, 2024

Merchant Cash Advances can be deceivingly attractive to businesses, offering a lump sum payment and quick access to cash. Still, it’s important to remember that they can also be incredibly costly. Interest rates can be high, and the repayment terms are often inflexible and unforgiving.

By Kenny Butler

•

September 15, 2024

Evaluating the credentials and experience of any individual or company you are considering for debt management, negotiation, or protection services is crucial. Some attorneys may have attended law school, but they may need to gain the unique knowledge and experience necessary to assist a business in dealing with debt negotiation, debt settlement, and aggressive MCA creditors. Bad Agents Firms that assign agents based solely on how much the client can pay should be avoided at all costs. Unfortunately, many debt relief agencies assign agents to your case based on how much money you can give them. It means that their competence, ability, experience, and knowledge may be limited. Do not allow yourself to become a victim of unqualified agents. Protect yourself by getting the information you need to gain control of your business debt.

By Kenny Butler

•

September 15, 2024

What is an MCA – Merchant Cash Advance? An MCA or Merchant Cash Advance is a type of alternative financing offered by lenders to business owners who may not qualify for traditional bank loans. The cash total of an MCA is based on a percentage calculation of the business’s future revenue or receivables and provides fast access to capital. MCA transactions are typically structured as a lump sum payment to the merchant, with the lender receiving a portion of the business’s daily sales for repayment. The MCA industry is not highly regulated, and, in fact, these lenders aren’t obligated to follow usury laws because, technically, a merchant cash advance is not a loan. It’s a purchase of future receivables. How did the MCA Industry grow? During the global economic downturn of 2008, merchant cash advances were one of many sectors to undergo significant change. MCAs stepped in to fill the gap left by traditional banks’ reluctance to lend after the economic downturn by providing short-term funding to struggling businesses. After the Great Recession, it became harder to get traditional small business loans because banks tightened their lending rules. Adaptations in the lending industry in response to the economic downturn have contributed to the sustained growth of merchant cash advances. In the 2010s, merchant cash advances (MCAs) continued to grow as larger lending institutions started providing MCAs and other alternative forms of financing. What are the MCA Companies Up to Exactly? There is tremendous competition in the MCA industry, with lenders who operate in the merchant cash advance realm working with brokers and funders who are all vying for the same business. The merchant cash advance industry has been under scrutiny in recent years for its questionable practices. Many MCA companies have been accused of manipulating their clients and competing with each other in unethical ways. High Rate One of the most common tactics used by MCA companies is to offer loans with high-interest rates and hidden fees. These high-interest rates can make it difficult for businesses to repay the loan, leading to a cycle of debt that can be hard to break out of. Additionally, some MCA companies have been known to offer loans without fully disclosing the terms and conditions, leaving borrowers unaware of what they are signing up for. Tactics Another tactic used by some MCA companies is to compete unfairly with each other by offering lower rates than their competitors. This can lead to a race-to-the-bottom mentality where businesses are forced into taking out loans from the lowest bidder regardless of their creditworthiness or financial situation. Predators Finally, some MCA companies have been known to engage in predatory lending practices, such as targeting vulnerable populations or offering loans without conducting proper due diligence on potential borrowers. This can leave businesses in an even worse financial position than before they took out the loan.

By Kenny Butler

•

September 15, 2024

What is Cash Advance Settlement? Business Cash Advance Settlement is a process of resolving debt that has been taken out through a Merchant Cash Advance (MCA). This type of financing allows businesses to receive a lump sum of money in exchange for future debit or credit card sales. The settlement typically involves negotiating with the MCA lender to reduce the amount owed and create a payment plan that works for both parties. Second Wind Consultants Second Wind Consultants is one example of a company that helps businesses resolve their MCA debt. They provide services such as debt elimination, restructuring, and negotiation with lenders to help businesses get back on track. Additionally, there are attorneys who specialize in Merchant Cash advance settlements and can provide legal advice and assistance during the process. Preparing for Settlements When attempting to settle an MCA debt, it’s important to be prepared with information about your current financial circumstances. This will help the MCA collectors or lenders understand your situation and come up with an agreement that works for both parties. Additionally, it’s important to be aware of any potential consequences of defaulting on an MCA loan, such as being sued by the lender or having your business assets seized. Overall, Business Cash Advance Settlement can be a difficult but necessary process for businesses struggling with MCA debt. With the right resources and guidance, however, it is possible to reach an agreement that works for both parties involved. Do It Yourself Debt Settlement If you want to control your own debt settlement process while avoiding large fees charged by debt settlement companies, you can use the Bardwell online course. Kenny Butler of Bardwell Creative has crafted a revolutionary, one-of-a-kind online course to educate business owners in the process of settling their debt for good. The Online Course The Business Debt Settlement Course is designed for those who need to stop the daily/weekly/monthly cash withdrawals and get out from under the crushing debt burden. The course provides clear systematic lessons that help business owners build up settlement funds and negotiate with creditors to settle their debts for a fraction of what they owe. Kenny Butler has created the only system available to business owners to deal with MCA and other crushing debt. He developed systematic debt settlement processes that are now available in this online course. With his expertise and guidance, business owners can learn how to avoid being taken advantage of by debt collectors and achieve results as low as 10% of the total amount owed. If you’re ready to take control of your financial future, check out the Business Debt Settlement Course by Bardwell Creative today!

By Kenny Butler

•

September 15, 2024

Understanding business debt relief means that regular payments can stop, allowing the business to return to positive cash flow. The most significant relief from debt comes from eliminating most of it through a single paid settlement. The business owner can use part of the freed-up cash flow to set money aside over time for a reduced one-time payment. It is the best option for businesses that want to get out of debt and gain financial freedom. That is full autonomy over their business and personal finances.

By Kenny Butler

•

September 15, 2024

There are several benefits to consolidating your business loans. First, you’ll have a single monthly payment, making budgeting easier. You may also be eligible for a lower interest rate and only have to deal with one set of terms and conditions. Additionally, consolidating your loans may improve your credit score since it will show that you’re managing your debt responsibly. Business Loan Consolidation: The Cons

By Kenny Butler

•

September 15, 2024

A merchant cash advance lawsuit is a legal action taken by a lender against a borrower for failure to pay back a loan. Generally, when a borrower does not make payments or fails to comply with the terms of the agreement, then the lender may pursue legal action in order to collect the debt. The lawsuit may include claims for breach of contract, usury laws violations, fraud, or unjust enrichment. If the court rules in favor of the lender in the lawsuit, then it may issue an order requiring the borrower to repay the loan plus interest or damages. It can also order other remedies such as seizing assets, garnishing wages, and placing liens on property.

By Dina Mousavi

•

September 14, 2024

As a business owner, you may have obtained a merchant cash advance (MCA) to help cover some of your expenses. An MCA is a short-term loan that is repaid through a set percentage of your future credit card sales or other receivables. If you’re experiencing difficulty making your MCA payments, it’s important to address whether your cash flow can sustain your MCA servicing.

By Kenny Butler

•

September 14, 2024

Running a business is no easy feat, especially if you’ve taken out several loans to help finance it. But while juggling different due dates, interest rates, and balances may seem overwhelming at first glance, there’s always an option for debt consolidation – which can simplify the repayment process while saving money in terms of lower interest payments. Before proceeding into uncharted territory, one should acknowledge the potential drawbacks of any significant decision. What is business debt consolidation?

By Kenny Butler

•

September 14, 2024

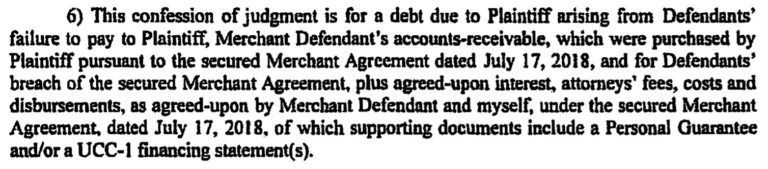

Confession of Judgement Filings 2019 In the first month of 2019, we researched and tracked almost 900 Confession of Judgement filings totaling just over $50 million in defaulted Merchant Cash Advance debt. Among them were: Custom Cabinet and Furniture Makers Medical Care and Health Services Distribution Companies Trucking Companies Breweries Lumber Companies Consulting Firms Contractors Landscapers Restaurants Hundreds of businesses were targeted by Merchant Cash Advance lenders who offered fast money without making clear to business owners what the details in the electronic contract they signed actually meant. Business owners often learn too late that Confession of Judgment in an MCA contract makes it impossible to stop a judgment from happening, because the MCA lender doesn’t have to alert the borrower when they file a COJ. These MCAs required borrowers to pay daily or weekly by electronic withdrawals from their credit card processors or straight out of their bank accounts via ACH (Automated Clearing House). Any downtick in revenue or delay in business contracts can instantly put a business owner in a position where they cannot meet the MCA debt service and pay their bills. Stacking MCA Debt Faced with these hard decisions, many owners will stack more MCA debt on top of what they already can barely pay hoping they can increase revenue to pay the debt service. The unrelenting cash withdrawals easily outpace the average business cycle, and a default is inevitable. Many of the hundreds of companies that defaulted at the beginning of the year would be profitable even if their debt service fell by only half. Merchant Cash Advance lenders do not negotiate this because of the leverage they have with the ability to file a COJ and get a quick judgment and seize bank accounts. Negotiation and restructuring can only properly begin after default. But to allow a business to survive and get back to positive cash flow, there must be a powerful strategy in place for restructuring the Merchant Cash Advance.

By Kenny Butler

•

September 14, 2024

Financial distress occurs when a company cannot meet its financial obligations and payment deadlines. It can be caused by a variety of factors, including economic downturns, changes in the industry, or mismanagement of resources. Financial distress can be a very stressful and emotional experience for business owners. It can be incredibly challenging if the business is closely tied to the owner’s identity and self-worth. The fear of failure and the uncertainty of the future can be overwhelming and lead to feelings of anxiety, depression, and even hopelessness. In addition to the emotional toll, financial distress can also take a physical toll on business owners. Stress Manifestations It can cause sleep problems, appetite changes, and physical health problems. It is vital for business owners to take care of their mental and physical health during this challenging time and to seek support from experts. Family Stress Stress from not having enough money might make it difficult for family members to get along. When business owners experience stress about making ends meet, they may withdraw emotionally and become focused on work. If the company is the family’s primary source of income, this may be extremely challenging. Financial worries and stress can affect communication and understanding among families. Poor Decision Making A deterioration in the state of the economy, increased levels of rivalry from other companies, or ineffective management of financial resources are a few of the many potential triggers for monetary difficulties. Inadequate accounts receivable and inventory management can make it hard for businesses to make money. The accumulation of debt and the inability to meet financial obligations on time are two potential outcomes of poor financial decisions. Troubles with money easily snowball into a negative cycle that is tough to escape. The Cost of Financial Distress Indirect Costs Companies with a lot of debt pay less attention to management and operations because they have to deal with financial issues. The cost of acquiring capital rises, compounding the burden of debt service. Financial distress can also lead to legal and administrative costs associated with the restructuring process. Hiring financial advisors, lawyers, accountants, and other professionals may be necessary to solve these problems. In addition, the company’s reputation and image may suffer, leading to potential customer losses that result in further financial hardship. Direct Costs If business bankruptcy is the result of financial distress, then there are many fees attached, such as: Legal fees Lawyer fees Management fees Auditor fees Financial advisor fees Filing fees Financial restructuring fees Liquidation costs Companies do not often survive business bankruptcy, and small businesses find it difficult to even raise the funds to pay for the filings. The Wall Street Journal ran a story in March of 2018 called, “Bankruptcy Is Often Too Costly for Small Businesses, Senate Panel Hears” Legal Action Lenders with no other option may be forced to take legal action against debtors who refuse to pay debts. Ignoring financial problems can also lead to insolvency proceedings, and the company may be subject to liquidation. In this case, creditors will attempt to recover their investments by disposing of assets or restructuring the debt obligations of the business.

By Kenny Butler

•

September 14, 2024

MCA stands for “merchant cash advance.” It is a way for a business to get money upfront in exchange for a share of its future credit card sales and receivables. Stacking MCA loans means taking loans from more than one MCA lender without paying off the previous MCAs. The borrower runs the danger of incurring excessive debt and experiencing financial stress by trying to juggle multiple daily payments.