Bardwell Creative

Our track record in assisting businesses across diverse industry sectors needing Merchant Cash Advance and business debt relief is something we pride ourselves on. Our proficiency in sophisticated debt negotiation has empowered entrepreneurs to liberate themselves from the shackles of debt, bypassing the path of business bankruptcy.

The World’s First AI Business Debt Consultant

Powered by OpenAI’s ChatGPT and Bardwell Creative’s Debt Settlement Course, we’ve created

Business Debt Expert GPT, the world’s first AI business debt consultant. This revolutionary AI expert has been trained on every detail of Bardwell Creative’s Business Debt Settlement Course to help business owners regain control of their cash flow and settle their debts.

Business Debt Expert GPT delivers systematic processes, personalized solutions, and 24/7 support to eliminate creditor interference and resolve debt issues. With deep knowledge of business debt negotiation, banking processes, the UCC code, and legal matters, this AI is your ultimate resource for navigating business debt challenges—and just about anything else you might want to know.

You can interact with Business Debt Expert GPT and get instant guidance whenever you need it. Request access today and experience unparalleled support in managing your business debt and beyond.

Introducing Business Debt Expert GPT!

The World’s First AI Business Debt Consultant

I’m trained on every detail of Bardwell Creative’s business debt settlement course. I know exactly how to handle every email, communication, and negotiation with creditors. Hardship letters, banking strategies that protect your cash flow.

Struggling businesses, don’t fall into a financial abyss!

Angela Glazier-Rines can be your lifeline. Invoke her expertise, rescue yourself from business debt quicksand, and find MCA debt relief.

You can call her here: (413) 613-4138

Looking for Answers? Angela Loves to Help!

Bardwell Creative has created this first-of-its-kind course to teach business owners how to permanently settle their merchant cash advances, bank loans, unsecured loans, vendor debts, and secured commercial loans as low as 10% of the original loan amount. Business owners can disengage from daily, weekly, and monthly withdrawals and regain cash flow control in just a few days.

The Business Debt Settlement Course Is Here

Along with

Merchant Cash Advance debt relief, the course is a system that allows you to settle most business debt for a fraction of what you owe.

You’ll learn how to:

- Permanently settle your Merchant Cash Advance debt for as low as 10% of what you owe

- Settle other business debts, such as loans from family and friends, unsecured loans, vendor debts, and secured commercial loans

- Take control of your cash flow

The course is designed for business owners who:

- Owe more than $10,000 in business debt

- Have tried to negotiate with their lenders but haven’t been successful

- Are struggling to make daily or monthly payments

The Bardwell Creative team has experience dealing with every kind of business debt. We are now teaching business owners how to get out of business debt on their own.

The Business Debt Settlement Course Is Here

The online course is easy to follow and can be completed in a few days and includes:

- A step-by-step guide on how to get out of business debt

- Email templates and scripts for negotiating with lenders

- Financial analysis tools to help you understand your options

Once you complete the course, you will have the ability to permanently settle your merchant cash advance debt, unsecured business loans, and other business debts as low as 10% of the original loan amount. You will also know how to avoid future debt traps and build a strong foundation for your business.

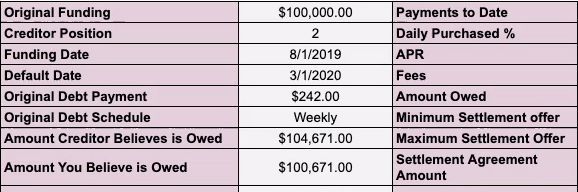

- $101,281 settled for $10,000

- $33,739 settled for $6,000

- $12,860 settled for $2,500

Business Debt Resolution

– Protect your accounts from seizure

– Prepare for the creditor’s lies and threats

– Create a system to communicate with creditors

– Track your numbers and stay three steps ahead

Phase I: Control Your Cash Flow

– Stop creditor harassment

– Settlement guidelines

– Summons, judgements, and 406 notices

– Deal with held receivables and frozen accounts

Phase II: Contact Creditors

– Create hardship documentation using our templates

– Download bank statements and learn WHAT to redact

– Stall your creditors using our templates

Phase III: Stalling

Did you receive a counteroffer from the creditor?

–

If NO: 1.9 – Use a “Counteroffer Requests” email template

–

If YES: 2.0 – Use a “Replies to an Offer” email templates

Phase IV: Settlement Negotiation

Will this course protect my accounts from seizure?

You might have signed a contract giving a creditor the right to seize any funds repeatedly. If you default and your creditor knows your bank accounts locations, they can (will) seize your money without prior notification. This course shows you how to minimize that risk.

Can creditors seize my employee’s payroll?

Yes, they can and will because they do not distinguish between what money gets assigned to payroll or anything else. Creditors and collectors do not care.

Is the course worth $2500?

Until now, the only options for small businesses struggling with debt have been to declare bankruptcy, hire a debt relief agency, or an attorney. These specialists often require a monthly retainer that may last for months or years, and bankruptcy often destroys the business. Our course eliminates the need for any of these options, and the one-time cost of the course, $2500, is less than the average monthly retainer fees of other companies.

Account Seizure

Course Price

How much time will the course take?

After completing the steps necessary to protect your accounts, the negotiation process takes about an hour or two a week until you achieve a settlement. An employee, or someone you trust, can use this course to negotiate with creditors on your behalf. We have 3rd party templates for all creditor communications.

What is the difficulty level of this course?

The “fill-in-the-blank system” for communicating with creditors makes writing emails easy. Phone scripts simplify the communication process and help you avoid missteps with duplicitous creditors.

How long does it take to settle a business debt?

This course gives you “breathing room” to build up settlement funds and establish settlement offers. Whether it takes two weeks or two years, the creditor is on your timeline now.

Why should I educate myself on business debt settlement?

Educate yourself to avoid being taken advantage of by debt collectors and debt relief companies. Bardwell Creative gives you the tools to make your own decisions based on a systematic solution.