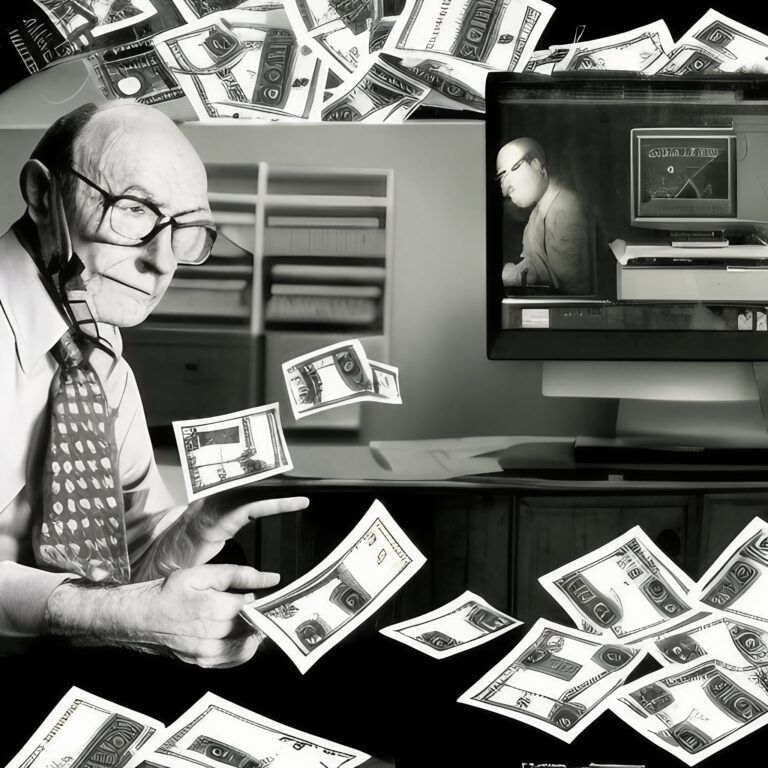

$3.4 Million Stolen and Over $1 Million Gambled Away: The Shocking Case of Mark Csantaveri

For years, we’ve witnessed the vulnerability of small business owners who have fallen prey to fraudulent debt settlement companies. These companies, under the guise of alleviating business debt, often fail to deliver, leaving these already struggling business owners in even worse financial trouble. The recent DOJ announcement regarding Mark Csantaveri’s scheme to defraud over 50 small businesses is a stark reminder of this danger.

The Impact of Fraud

The accused, Mark Csantaveri, and his conspirators, according to the criminal complaint, promised debt relief but instead siphoned over $3.4 million for personal use, including more than $1 million in gambling expenses. According to the DOJ, Csantaveri’s fraudulent activities targeted small businesses through his companies, MCA Cure, LLC, LDMS Group, LLC, and Evergreen Settlement Group, LLC. These entities allegedly falsely advertised their ability to settle business debts for a fraction of the original amounts, preying on financially struggling businesses.

The Scope of the Scam

- 50+ Small Businesses Affected: Allegedly defrauded over 50 small businesses across various states.

- $3.4 Million Misappropriated: Funds intended for debt settlement were allegedly used for personal expenses, including over $1 million at casinos.

- False Promises: Businesses were promised debt settlements, but according to the criminal complaint, Csantaveri and his co-conspirators never contacted the creditors.

Case Example: MCA Cure, LLC

One victim, a restaurant in College Park, Maryland, entered a debt consolidation agreement with MCA Cure, LLC, expecting their $200,000 debt to be negotiated down. Over two years, they paid $149,400 to MCA Cure, only to discover that they never contacted the creditors. Instead, the funds were allegedly transferred to personal accounts.

Source: CRIMINAL COMPLAINT

Another Victim: LDMS Group, LLC,

A manufacturing company in Dayton, Ohio, paid $25,745 to LDMS Group, LLC, for debt relief services. However, they found that their creditors were never contacted, and Csantaveri allegedly diverted their money for personal use.

Source: CRIMINAL COMPLAINT

Further Deception: Evergreen Settlement Group LLC

An auto body shop in Michigan entered an agreement with Evergreen Settlement Group LLC, paying $37,800 in the hopes of settling its $321,318 debt. However, it eventually discovered that no negotiations had occurred, and its funds had been misappropriated.

Source: CRIMINAL COMPLAINT

The Importance of Taking Control

Business owners struggling with debt can find themselves in even deeper trouble if they rely on fraudulent companies. MCA lenders will continue to pursue repayment, regardless of whether a business owner has been defrauded. Business owners must take control of their debt situations promptly and effectively. No one will replace them in taking care of their business debt issues. They must act to protect themselves because no one else will care as much or do a better job than they can, especially when equipped with the right tools and knowledge. By taking responsibility and using reliable resources, business owners can navigate their debt challenges more successfully and secure a stable financial future for their businesses.

Our Solution: The Bardwell Creative Debt Settlement Course

At Bardwell Creative, we’ve developed a comprehensive online course to empower business owners to independently manage and settle their debts. Our course offers:

- Step-by-Step Guidance: A detailed, easy-to-follow process to resolve business debts.

- Practical Negotiation Tools: Email templates, scripts, and financial analysis tools.

- Proven Results: Learn how to settle debts for as low as 10% of the original amount.

Why Our Course is Different

Unlike debt settlement companies that may not have your best interests at heart, our course provides business owners with the knowledge and tools they need to take control of their financial future. The course costs far less ($2500.00 with chat support) than hiring a debt settlement company, and it equips you with skills that can be applied immediately and effectively.

Not a Consolidation Scheme: A Legitimate Debt Settlement Solution

Our course is not a consolidation scheme. It is a legitimate, step-by-step debt settlement process specifically designed for business owners to manage and settle their debts independently. Developed with the expertise of lawyers, CPAs, and financial professionals, our course offers precise, real-world methods that have been thoroughly proven to work. We empower business owners to confidently take control of their debt situations and achieve financial stability without the risks of relying on potentially fraudulent debt settlement companies.

Conclusion: Take Responsibility and Act Now

Business owners must take responsibility for their debt situations. By enrolling in our course, you can avoid the pitfalls of fraudulent companies and take definitive steps to regain control of your finances. Don’t let your business fall victim to incompetence or fraud. Take action today and secure a brighter financial future for your business.

Learn more about

our debt settlement course and how it can help you take control of your business debt

here.

Similar Posts