Understanding business debt relief means that regular payments can stop, allowing the business to return to positive cash flow. The most significant relief from debt comes from eliminating most of it through a single paid settlement. The business owner can use part of the freed-up cash flow to set money aside over time for a reduced one-time payment. It is the best option for businesses that want to get out of debt and gain financial freedom. That is full autonomy over their business and personal finances.

Business Debt Survival

For the sake of the long-term survival of your business, you must protect all of its finances from creditors. Debt collectors are trained to lie, cajole, threaten, or intimidate people to get information that could lead them to your money. Business owners should never trust debt collectors and should not give in to pressure or threats. Taking the necessary steps to protect yourself and your business will provide all the relief you need for long-term financial stability.

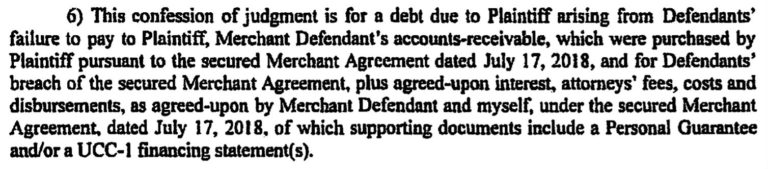

If you are struggling with Merchant Cash Advance debt, read this comprehensive post about how MCA debt relief works and how to survive it.